Buy-In Process & Buyer Cash Substitution

AD Clear's comprehensive procedures are designed to effectively manage failed delivery obligations, ensuring market stability and safeguarding the interests of all participants.

Buy-In Process

-

Buy-In Orders for Failed Deliveries

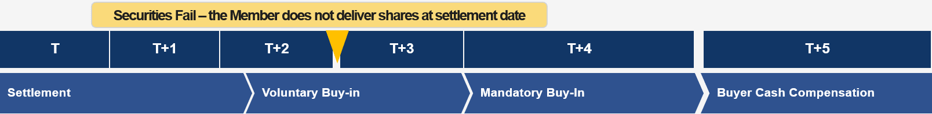

- Initiation: If a Clearing Member or Settlement Agent fails to meet the delivery obligation by the Intended Settlement Date (T+2), AD Clear initiates a Buy-In process.

- Notification: A Buy-In Order is generated and sent to the Exchange Trading System from T+2 to T+4. If the sell positions are not settled on the settlement date (T+2), Failed Member can initiate a Voluntary Buy-in on T+2 and T+3. If a failed sell instruction has not been settled at the end of T+4, a Mandatory Buy-In procedure will be initiated by AD Clear.

-

Execution of Buy-In Orders

- Matching: The Buy-In Order is displayed and matched in the Exchange Trading System according to the Exchange Rules.

- Settlement: The seller of a Buy-In trade must deliver the securities on the same day (T+0). If the seller fails, their Clearing Member is responsible for fulfilling the delivery obligation.

-

Buy-In Trades

- Settlement: The Buy-In Trades are settled on the trade date to ensure the failed delivery obligations are met promptly.

Buyer Cash Substitution

-

Cash Compensation for Failed Deliveries

- Compensation Trigger: If the delivery obligation remains unmet by the 3rd business day after the Intended Settlement Date (T+5), the buyer is eligible for cash compensation.

- Calculation: Buyer Cash Compensation is calculated as below:

a) For Failing party (to pay): Remaining Settlement Amount in Tier 1 settlement instruction * 10 %

b) For Impacted Party/Parties (to receive): Remaining Settlement Amount in Tier 1 settlement instruction * 10%

-

Payment of Cash Compensation

- Disbursement: AD Clear disburses the cash compensation to the buyer's account to cover the shortfall.

- Notification: The buyer is notified of the compensation payment and the details of the calculation.